Have you noticed your claim denials creeping up lately? Fortunately, you’re not alone in fact, small practices report that almost 1 out of every 10 claims gets denied. According to a state-of-claim report, 68% of providers say inaccurate or incomplete patient data at intake is one of the biggest drivers of claim denials.

When those denials start stacking up, the result is lost revenue. But the good news is that all of these denials are avoidable, and I’ll tell you exactly how to take control of denial codes before payers take advantage.

In this blog, we’re hunting down the top 5 denial codes that sneak up on small practices.

This guide covers the top CARC/RARC denial codes affecting small practices and aligns with payer rules, CMS guidelines, and RCM best practices.

What You Need to Know About Denial Codes?

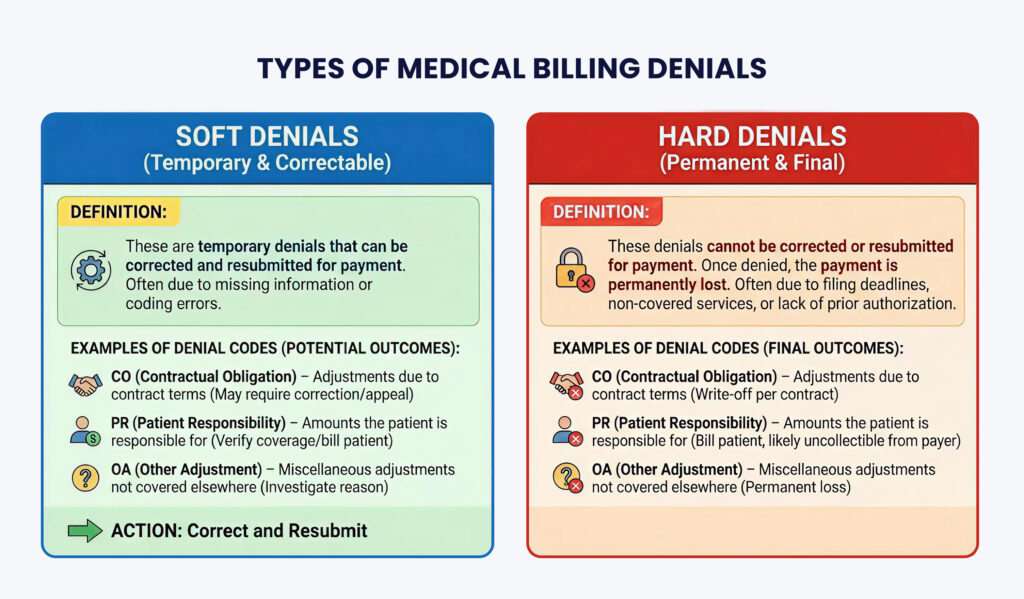

Denial codes? They’re the sneaky errors quietly eating away at your medical practice revenue. Simply put, denial codes act as translators for insurance denials; they explain exactly why a claim was rejected or paid less than expected.

Understanding these codes is essential for small practices. They help you identify the root cause of denials and give you the chance to fix errors and resubmit claims.

Tip: Always check the denial letter or Explanation of Benefits (EOB), which clearly states your appeal rights and deadlines.

These codes follow standardized CARC and RARC formats used by Medicare, Medicaid, and commercial payers.

Why Small Practices Struggle With Denial Codes?

Running a small practice means juggling multiple balls at once. Does it sound familiar to you? Sometimes you have to act as both the front desk and the back desk.

The problem starts when you hire someone or personally handle a task beyond your expertise.

For instance, as a provider, you know what is rendered, but you may not always know what is billable, covered, or compliant in the eyes of payers. And that’s precisely where denial codes start creeping in.

| Do you know? Small Practices Are Constantly Losing Revenue Every Day to a $47 Billion Denial Crisis. Tip: Handling medical billing on your own may seem cost-saving, but it often ends up costing more due to lost revenue. Partnering with a professional medical billing company helps small practices reduce denials, boost collections, and protect their bottom line. This issue typically stems from eligibility failures, coding inaccuracy, and breakdowns in front-desk RCM workflows. |

The Denial Codes You Must Avoid to Stay Penalty-Free in 2025–2026

Denial codes are often the real culprits behind delayed revenue, lost payments, and even compliance penalties.

In this section, we’ll break down the top 5 denial codes you must watch out for, and how avoiding them can save your practice time, money, and unnecessary headaches.

1. CO-16 – Missing or Incomplete Information

CO-16 denials happen when key information is missing or entered incorrectly on a claim, such as patient demographics, provider NPI, or required modifiers. Even minor informational errors can trigger denials, slowing payments and creating extra work for staff.

Example: A claim is submitted without the provider’s NPI. The payer denies it until the missing information is added. CO-16 falls under administrative/informational denials.

2. CO-50 – Non-Covered Services

CO-50 indicates that the billed service is not covered under the patient’s insurance plan. This type of denial is usually permanent and requires careful verification before services are rendered.

Example: A patient receives a cosmetic dermatology procedure. When the claim is submitted, the insurer rejects it because elective cosmetic services aren’t covered. Often tied to payer medical policies, LCD/NCD coverage limits, or benefit exclusions

3. PR-49 – Patient Not Eligible / Coverage Lapsed

PR-49 shows up when a patient isn’t eligible for coverage on the date of service. This is common when insurance lapses or the patient switches plans. This denial type directly relates to incomplete real-time eligibility verification.

Example: A patient’s insurance ends on December 31, but they receive care on January 2. The claim is denied due to ineligibility on the service date.

4. CO-22 – Payment Adjusted Due to Contractual Obligation

The CO-22 denial code occurs when a claim is rejected because another insurance payer has been identified as primary, and the claim was not submitted to them first.

Example: A patient has Blue Cross (primary) and Aetna (secondary). The clinic submits the claim to Aetna first, and it’s denied with CO-22 until Blue Cross processes it. This reflects Coordination of Benefits (COB) errors.

5. CO-11– An Error In Coding

CO-11 denial code occurs when the diagnosis code submitted in the claim doesn’t match the rendered healthcare procedure.

Example: A patient with acute sinusitis is coded as J00 (common cold) instead of J01.90. The claim is denied until corrected.

Tips to Beat the Clock: Proven Ways to Prevent Claim Denials

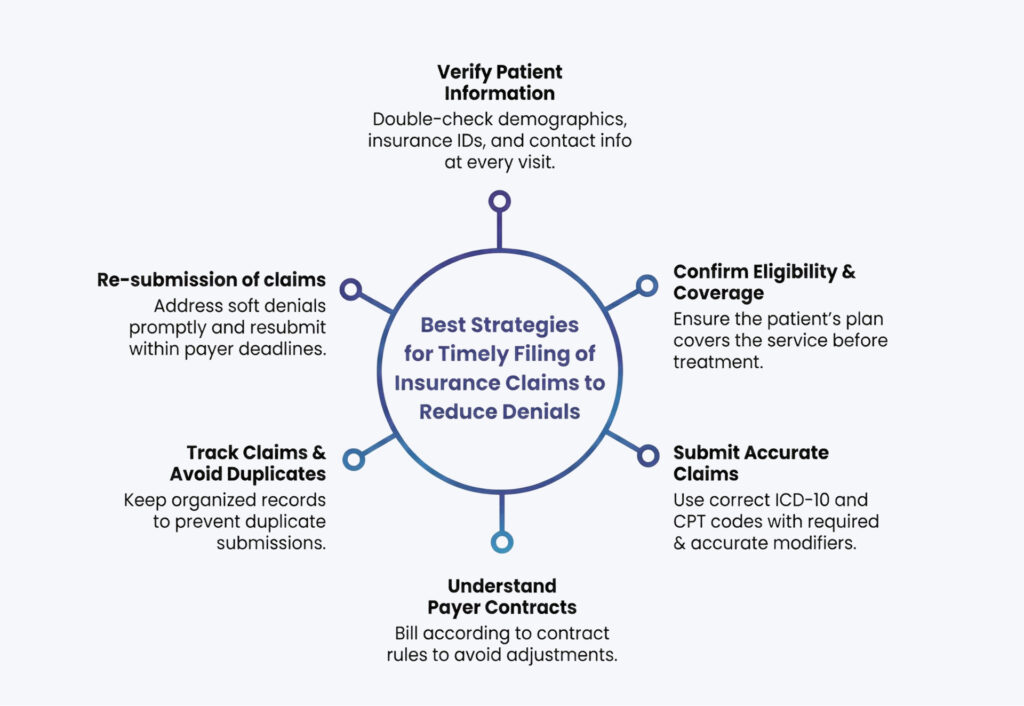

Whether you run a small practice or a large healthcare facility, denials don’t have to be your headache. The trick is simple: keep a close eye on your denial trends and stay one step ahead of the payers.

Here’s the reality: Many small practices rely on just one biller to handle almost everything: scheduling appointments, managing the front desk, etc. It’s simply too much for one person to handle perfectly. With that many tasks, mistakes are bound to happen, and payers are well aware of them.

By implementing the right strategies, you can reduce errors, speed up reimbursements, and maintain healthy cash flow. Here’s how:

Thinking About Outsourcing Your Medical Billing?

| Get paid instantly with Dastify Solutions Denial Management Services. Whether you run a small clinic or a large medical facility, having a dedicated billing and coding team can make a world of difference. With proper Revenue Cycle Management (RCM) in place, we ensure claims are submitted and re-submitted efficiently, denials are tracked and resolved quickly, and your practice gets paid accurately and on time. Our denial workflows use CARC/RARC mapping, payer-specific rulesets, and automated denial pattern detection. Get a Free Consultation Now |

Wrapping It Up

Claim denials may look small on paper, but they create significant setbacks, slower payments, extra admin work, and unnecessary revenue loss. The top denial codes we covered can hit any practice, but the good news is they’re highly preventable when you have the right team behind you.

Why does outsourcing to a medical billing company make all the difference?

Fewer errors: Experts catch coding, documentation, and eligibility issues before submission.

Faster payments: Clean claims mean quicker approvals and steady cash flow.

Proactive denial management: Every denial is tracked, appealed, and fixed; no lost revenue.

Full RCM support: From coding to collections, your entire billing cycle stays optimized.

With a professional medical billing company handling the complexities, your practice can finally breathe more time for patients, less stress over revenue, and zero fear of avoidable denials.