Introduction

The EDI 837 is the electronic data interchange (EDI) standard that’s been mandated by the feds for healthcare providers to submit claims to payers. It replaced those old paper-based claim forms like the CMS-1500 and UB-04 and turned healthcare claim information into a structured format that systems can just read off the bat, validate and process automatically.

This guide is going to cover the 3 primary 837 transaction types (837P, 837I and 837D), the nitty gritty of implementation requirements, format specs, and compliance considerations for healthcare organizations that are getting into claims submission. And as a heads up, it’s gonna focus specifically on submission and skip over the other EDI transactions like the 835 electronic remittance advice or the 834 benefits enrollment transaction.

The Bottom Line: EDI 837 is the standardized format that’s required by HIPAA for sending healthcare claims from providers to payers – which lets insurance companies automate the claims process and cut down on all that paperwork.

By The End of This Guide, You’ll know!

- About the 3 main 837 transaction types, and when to use them

- What the HIPAA 5010 format specs are and what it takes to comply

- How to implement electronic claims submission, and some best practices

- About some common challenges with claims processing, and some solutions that really work

- How to look at ROI considerations and optimization strategies for your revenue cycle management

Understanding EDI 837 Healthcare Claims

EDI 837 is the X12 transaction set for electronic claim submission under HIPAA 5010, and its basically the only file format that lets you structure all the necessary patient, provider, service, and payment info in a way that makes sense to everyone involved.

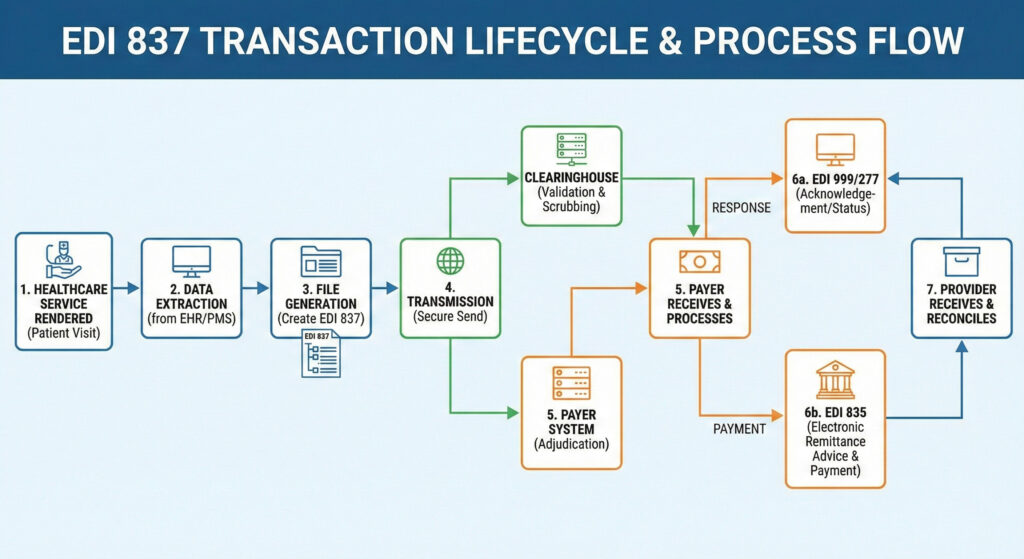

When a provider submits an EDI 837, it kick-starts the entire claims processing workflow which – all being well – should end with reimbursement. When it gets back from the payer, there are all these subsequent EDI transactions – the 999 confirms they got it, the 277CA gives you the status, and the 835 delivers electronic remittance advice with the payment details.

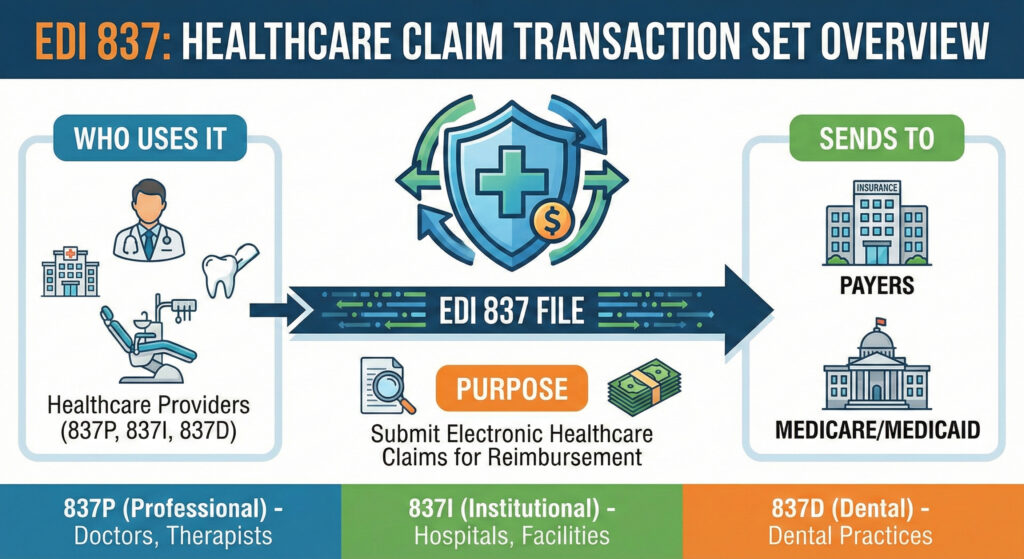

EDI 837 Transaction Types

EDI 837P (Professional): that’s the one that’s gonna be used by physicians and healthcare professionals for submitting claims for outpatient services – all those office visits, diagnostic tests and professional services that aren’t provided in a hospital setting.

EDI 837I (Institutional): this one’s for hospitals and medical facilities – it’ll handle all the inpatient stays, outpatient services and the sort of care that needs to be billed separately.

EDI 837D (Dental): and this one’s for dental practices and oral healthcare providers – it’ll deal with the unique dental procedure codes and info that’s needed for submitting dental claims.

Each of these transaction types is aimed at its own specific provider group but uses the same underlying EDI standards, which is just great for keeping things consistent.

Claims Data Elements

When the EDI 837 is transmitted, it’s sending a load of structured patient demographics – names, birthdays, identifiers, subscriber relationships and that sort of thing. That patient info ties in directly with insurance details and eligibility for healthcare benefits

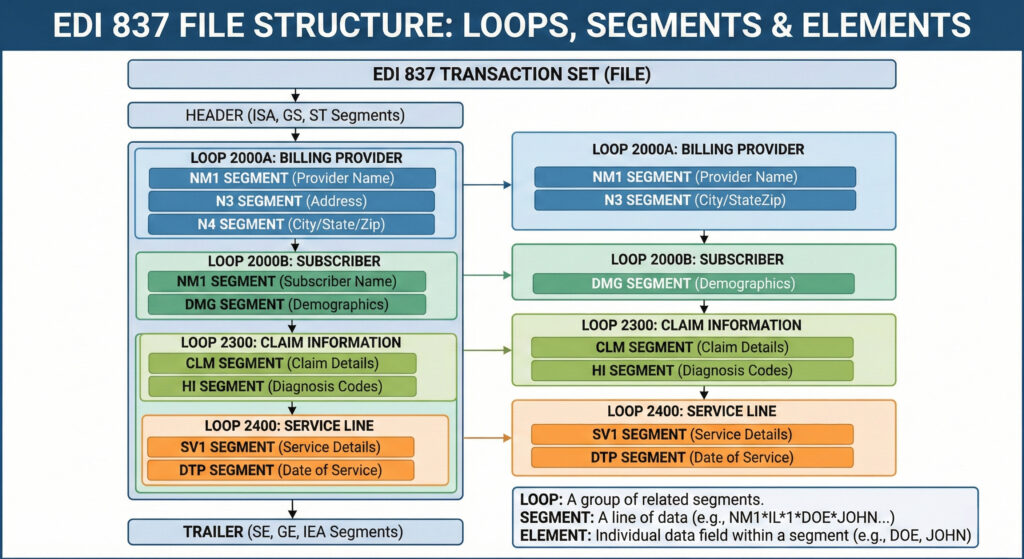

Provider info includes NPI numbers, taxonomy codes and billing details. The document has a hierarchical structure so that each provider segment (NM1) links to specific claims and services.

Service details cover CPT/HCPCS procedure codes, ICD-10 diagnosis codes, service dates and billed amounts – things like that. A good example is a single care encounter with a specific procedure, charge amount, units of service and diagnosis code pointers all wrapped up in an SV1 segment

Having this standardized data makes sure that the claims get adjudicated accurately and gets rid of all the ambiguity and when all payers accept claims in the same format with the same code sets, data accuracy just gets better and better.

EDI 837 Format Specifications and Structure

Building on what we just discussed, this section goes into the technical format requirements that govern how claim file submissions have to be built.

HIPAA 5010 Compliance Requirements

Since 2012, all electronic claims have to be in line with HIPAA 5010. That established the X12 ANSI format where segments have all the necessary data points, separated by tildes (~) with asterisks (*) in between the elements within each segment.

Required fields include things like CLM05 (claim frequency), provider NPIs and diagnosis codes in the HI segment (HIABK:S72.001A for an ICD-10 diagnosis code for example). And there are some fields that are only required under certain circumstances – like prior authorization numbers (REFP4) if the authorization was needed.

The hierarchical structure keeps the context of related elements all connected. A diagnosis belongs to a specific claim (CLM segment), which is tied to a patient (NM1 segment) under a particular provider. And that’s just the sort of thing that can span hundreds of segments per patient claim batch in larger institutions.

Insurance companies and health maintenance organizations make their own EDI 837 requirements by creating companion guides that fill in some of the gaps left out by the standard implementation guides. These documents help to sort out which rules apply in certain situations, lay out specific validation rules and business logic that only apply to specific payers.

Take Medicare and Medicaid for example – they have companion guides that cover specific billing requirements that are different from those of commercial payers. If you’re dealing with one of these payers, you need to take those requirements into account to avoid denied claims.

Claims Clearinghouse Processing

Claims clearinghouses act as a middleman between your practice and the payers you are submitting to. They handle EDI 837 transmission and the process of connecting to different payers. Clearinghouses can translate your billing data from your practice management system into the EDI 837 format that payers need.

For healthcare providers without the in-house expertise to handle their own EDI, clearinghouses can offer multi-payer connectivity through just one integration point. They will do the initial validation, forward your claims on to the payers, and even gather up the responses – which makes it a whole lot easier to manage direct connections with dozens of insurance plans.

Some things to keep in mind: maintaining the correct segment hierarchy, filling in all the mandatory fields and adapting to the specific payer requirements spelled out in their companion guides – all these things will directly affect your implementation process

EDI 837 Implementation and Best Practices

Once you have a good grasp on the format specs, you can approach implementation in a methodical way to make the most of the benefits of electronic claims submission.

Implementation Process

You should implement EDI 837 electronic claims when you’re looking to cut your administrative costs, speed up payment posting and improve your cash flow through faster reimbursement cycles.

- Check your current billing software and EDI capabilities: Take a look at whether your practice management system can handle EDI 837 generation or if you will need a clearinghouse to make it happen. Take a look at where in your workflow manual errors are occurring and identify those gaps.

- Select a clearinghouse or whether to go direct with payers: Decide whether direct submission to major payers or a clearinghouse is the way to go. Consider factors like volume, payer diversity and your in-house technical resources.

- Configure the transaction format for EDI 837 and patient-specific companion guides: Map your internal data fields to the X12 EDI segments using an EDI translator or a clearinghouse mapping tool. Load in the payer-specific rules and requirements for formatting and validation.

- Test your claims submission using some test data and validate everything: Send some test transactions to see if they will be accepted and verify the syntax of your ASC X12, the situational rules and payer requirements. Do this before you go live.

Go live with electronic claims submission and monitor the results – Start submitting live claims while tracking your acceptance rates, reasons for rejection and processing times. Use that data to refine your configurations based on what the payers are telling you.

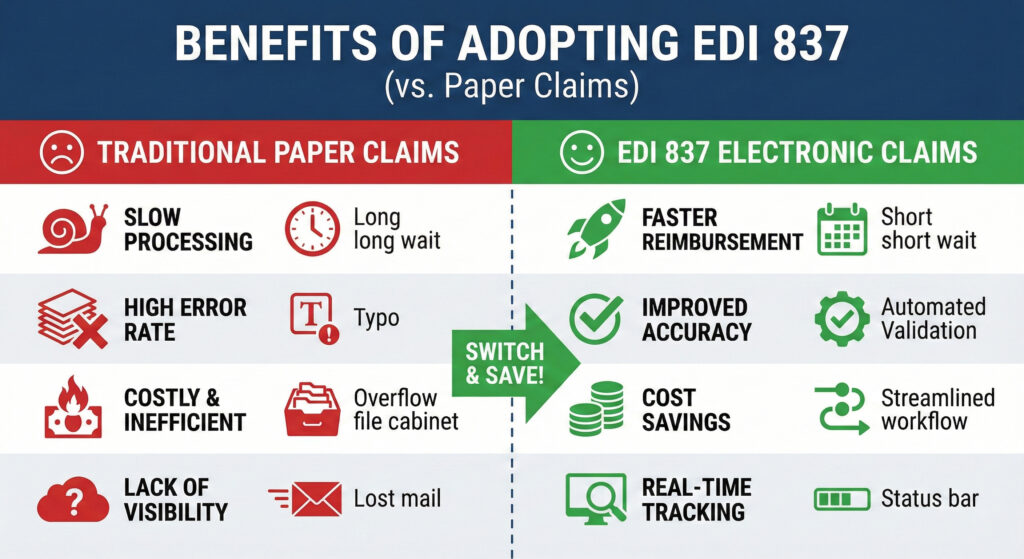

EDI 837 vs. Paper Claims Comparison

| Feature | EDI 837 Electronic Claims | Paper-Based Claims |

|---|---|---|

| Processing Time | 24–48 hours for most | 2–4 weeks on average |

| Error Rates | Lower through automation | Higher because of manual processing |

| Cost Per Claim | $0.50–$3.00 | $6.00–$25.00 |

| Compliance | Automatic 5010 HIPAA compliance | Manual verification required |

| Payment Speed | 10–14 days on average | 30+ days is common |

| Co-pays/Adjustments | Standardized reason codes for adjustments | Manual interpretation needed |

Common EDI 837 Challenges and Solutions

Even though there’s standardization involved, EDI 837 claims processing does present challenges that can affect acceptance rates and payment timelines.

Claims Rejection and Denial Issues

Rejected claims often happen because patient demographics are wrong, or the provider NPIs are invalid, or there are missing prior authorization numbers or diagnosis codes that don’t support the services being billed for. These errors delay payment and make it harder to manage your workload.

Do data validation in real-time as patients are getting services so you can confirm their eligibility and benefits info. Make sure you have accurate provider databases with up to date NPIs & taxonomy codes. Confirm your eligibility checks are getting the coverage details including the required referrals or authorizations.

Payer Companion Guide Compliance

The varying requirements across multiple payers can create a lot of complexity, especially when payers change or update their companion guides without giving a lot of notice.

Use an EDI software that can accommodate rule variations with payer-specific validation. Establish a process to monitor for updates to companion guides from key payers. Consider working with a clearinghouse that manages companion guide compliance as part of their services to take the effort out of it for your internal team.

Claims Processing Delays

Delays happen when claims are incomplete, formatting errors cause rejections or the clearinghouse is bogged down – all these things can cause problems for the patient accounts and your revenue cycle performance.

Do front-end validation to catch errors before submission. Use real-time claims scrubbing to catch missing or invalid data. Consider working with multiple clearinghouses if you’ve got the volume and will justify the redundancy. Monitor your acceptance rates and address those repeated rejection patterns that you’re seeing.

Tackling these challenges will put you in a position to get the full benefits of electronic claims submission.

Conclusion and Next Steps

EDI 837 is the core of a streamlined health care claims process. By making it standard for health care providers to send claim details to their payers electronically, it reduces the costs associated with processing claims, boosts data reliability and gets them paid faster for the services they’ve delivered.

Practical things to do right now:

- Take a good hard look at how your practice is handling claims these days – how many are still going in on paper, and what are the rejection rates

- Check out some companies that specialise in EDI – find the ones that’ll best fit with the payers you work with and the volume of claims you send out

- Crunch some numbers to figure out the potential return on investment from going digital – that includes all the cash you’ll save and the speed at which you can get paid

- come up with a timeline for getting this set up that matches your practice’s workflow and staff training needs

You might also want to look into using the EDI 835 for getting electronic remittance advice and doing electronic funds transfers, and also claim status inquiries EDI 276/277. And don’t forget there are likely other ways to automate more of your revenue cycle that you can tap into now that you’ve got electronic claims going.